TUS consumers are purchasing fewer items across categories, reflecting subtle shifts in shopping behavior with meaningful consequences for consumer-packaged-goods players.

Despite a relatively strong economy and low unemployment, consumers are buying fewer items—and spending more to do so. The volume declines in consumer packaged goods (CPG) are dramatic, especially considering the growth that occurred in the early days of the COVID-19 pandemic.

The volume decline is pervasive across categories, from grocery to personal care and household products. US CPG volume declined 2 to 4 percent on average, with larger subcategories such as vitamins and supplements suffering 5 percent declines compared with 2022 figures.1 Even the holiday season wasn’t enough to open a proverbial parachute: grocery volume declined 2 percent in November and December 2023, compared with the same period the year before.

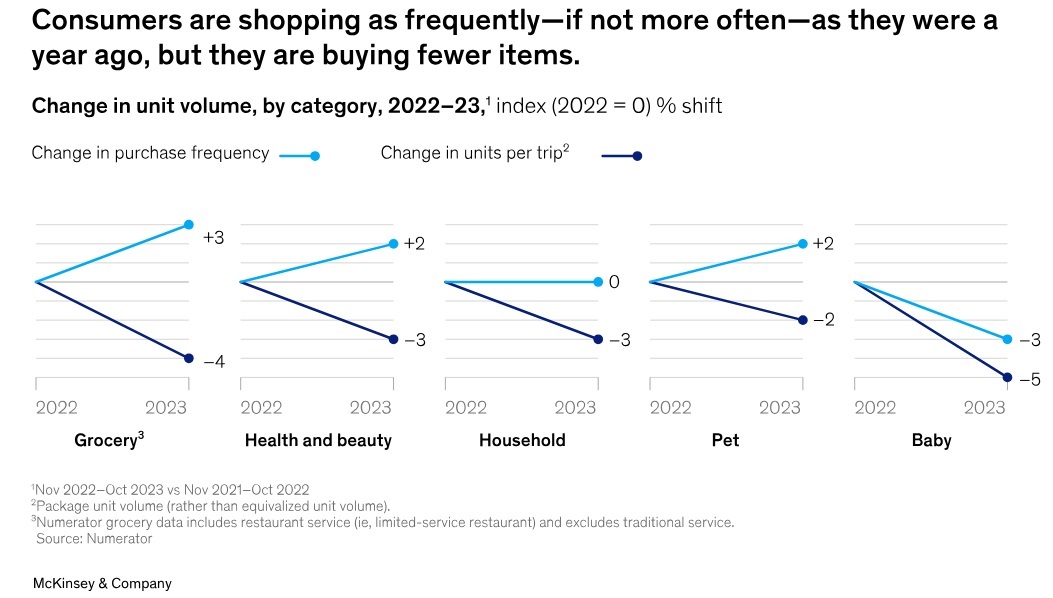

This is happening even as consumers increase their shopping frequency across most channels and categories, creating a confusing set of circumstances for CPG brands to navigate.

In this article, we dive into the specifics of the recent CPG volume declines, examine McKinsey research to understand why consumer behaviors are shifting, and explore what this means for US CPG businesses in 2024.

Consumers are shifting their behavior in small but meaningful ways

We have identified two primary ways that consumer behavior has shifted. First, consumer purchase occasions occurred at the same—and in some cases, at a higher—frequency than in 2022, but consumers purchased fewer items on each trip (Exhibit 1). Units per trip declined by 3 to 5 percent across the grocery, health and beauty, and household categories, outweighing the growth in frequency of purchase occasions (up by no more than 3 percent) in the same categories. (For more on how grocery volumes could shift, see sidebar, “Are GLP-1s affecting consumer spending?”)

But among the volume declines, there were green shoots: Gen Z consumer purchase occasions for grocery and health and beauty products increased 10 percent in 2023, compared with 2022 (although with slightly fewer units purchased on each occasion). That means Gen Zers, on average, went grocery shopping one to two additional times per month and shopped for health and beauty products one additional time every other month in 2023.

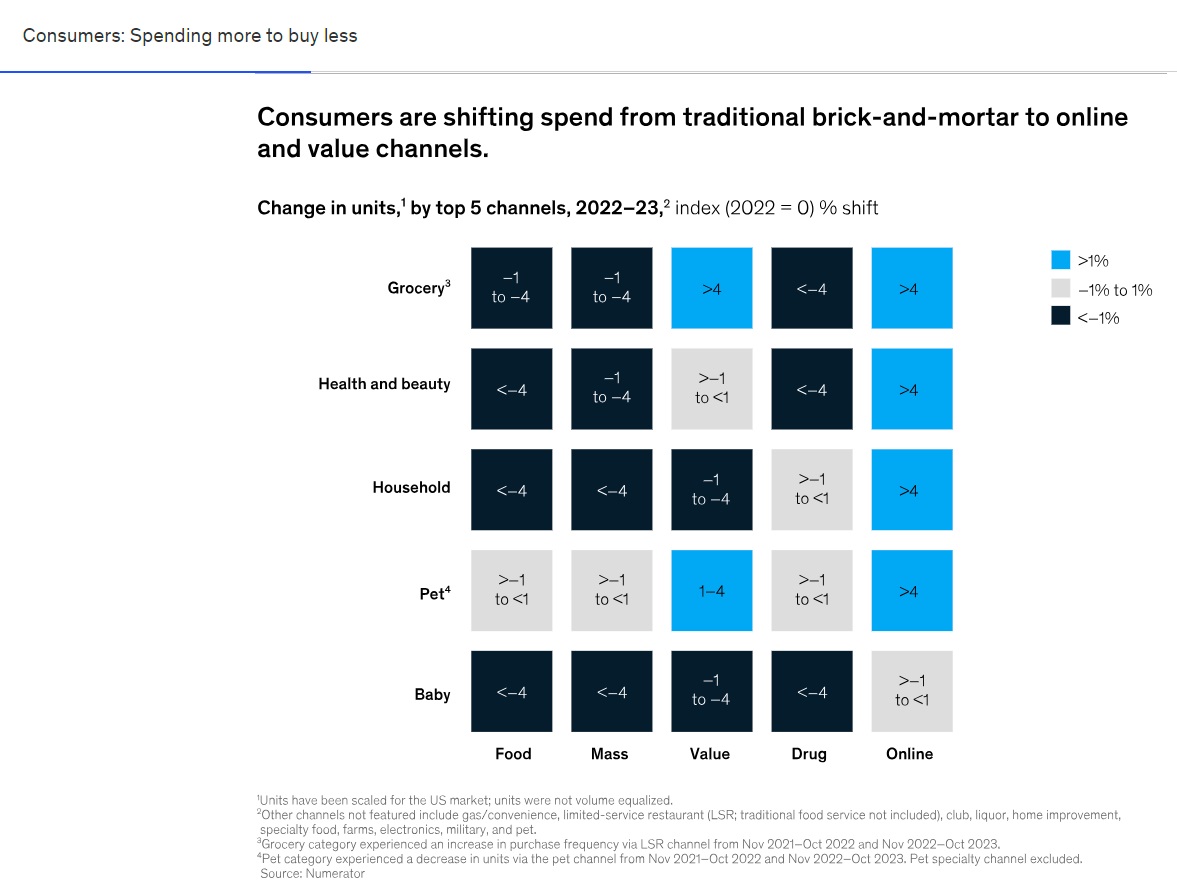

Analyzing five consumer goods categories across five sales channels, we see that consumers shifted their spend away from traditional brick-and-mortar channels and toward online and value channels (Exhibit 2). Still, the volume losses in brick-and-mortar outweighed the volume gains made in online and select value channels.

Among the channels analyzed, grocery items sold through food channels and all categories sold through mass channels represent the largest volumes in consumer goods—and suffered the biggest declines in 2023, along with drug stores. Comparatively, four out of five categories of CPG found volume growth online. The dollar channel demonstrated mixed results, with increases in grocery and pet segments but decreases in household and baby units.

Amid the general downturn, however, there were pockets of resilience. Online unit sales, for example, consistently grew by more than 4 percent. Among Gen Z consumers, this shift is even more pronounced: online unit sales from these consumers increased at nearly two times the rate of increases in online unit volume for other generations. Gen Z also helped cushion volume declines in mass and dollar store channels.

Five strategies can help CPG players combat volume declines

As long as above-average inflation, geopolitical risks, and uncertainty regarding interest rates persist, consumers are likely to continue to purchase fewer goods. In the meantime, there are five actions CPG executives can take to hedge against what the next two to three quarters may hold:

Evaluate the portfolio to identify pockets of headroom. As consumers become choosier, it’s important to reevaluate product assortment and portfolio investment. It may be time to exit parts of the portfolio that don’t fit current consumer demand, or in other cases, double down on areas where consumers are expressing a need. This may include expanding offerings across a certain price point or in-demand categories, such as health and wellness.

Accelerate growing channels. Companies should ensure products are available across value and online channels, where there is more momentum compared with mass, food, or drug channels. In some cases, companies could consider unique product offerings (where size or packaging may differ from in-store offerings). Consumer businesses could also invest in the “digital shelf,” or the online environment where products appear.

Reconsider pricing and promotion strategies. Most consumers still express concerns about price and are shopping based on promotional strategies. Input costs remain high, and price increases may be necessary to maintain margins. That said, consumer businesses may want to reevaluate price pack architectures (that is, finding ways to offer consumers the goods they want at prices they are willing to pay). Consumer brands could also offer value promotions that create “reasons to buy” during the more-frequent shopping trips consumers are making.

Continue to invest in brand loyalty. While it may be tempting to step back from wide-ranging brand marketing to focus solely on performance marketing, where sales impact is often directly measurable, consumer goods companies should still invest in consumer acquisition and loyalty. Building “brand love” may be the best way to entice cautious consumers to add items to their physical and digital shopping carts.

Calibrate supply chain to demand. To ensure products were stocked during the COVID-19 pandemic, consumer goods businesses may have created redundancies within their supply chains. But with decreased demand today, consumer companies should consider using AI and analytics to reevaluate their supply chains and create flexibility to adapt to changing volumes.

As uncertainty over the economy lessens and a clearer forecast emerges, consumers may once again increase the number of purchases they make. But CPG players that wait around for that moment—without finding ways to recapture the consumer today—stand to miss out for good.

Fuente de nota e imagen: https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/consumers-spending-more-to-buy-less